We Predict: 10 Stories We Expect to Write in 2022

How do you top a year like 2021? Well, we might have said the same thing a year earlier, when COVID-19 led to nationwide lockdowns, a three-month shutdown of North American automotive manufacturing and what looked to be the start of another serious recession.

During the past 12 months we saw what looked like a record rebound of the auto industry melt away due to semiconductor shortages, which led to record increases in new car prices. We’ve also seen EV sales finally show serious momentum.

So, what can we expect to see in 2022? That’s the question we asked of TheDetroitBureau.com’s editorial team and here are the 10 stories they expect will top the headlines in the coming year.

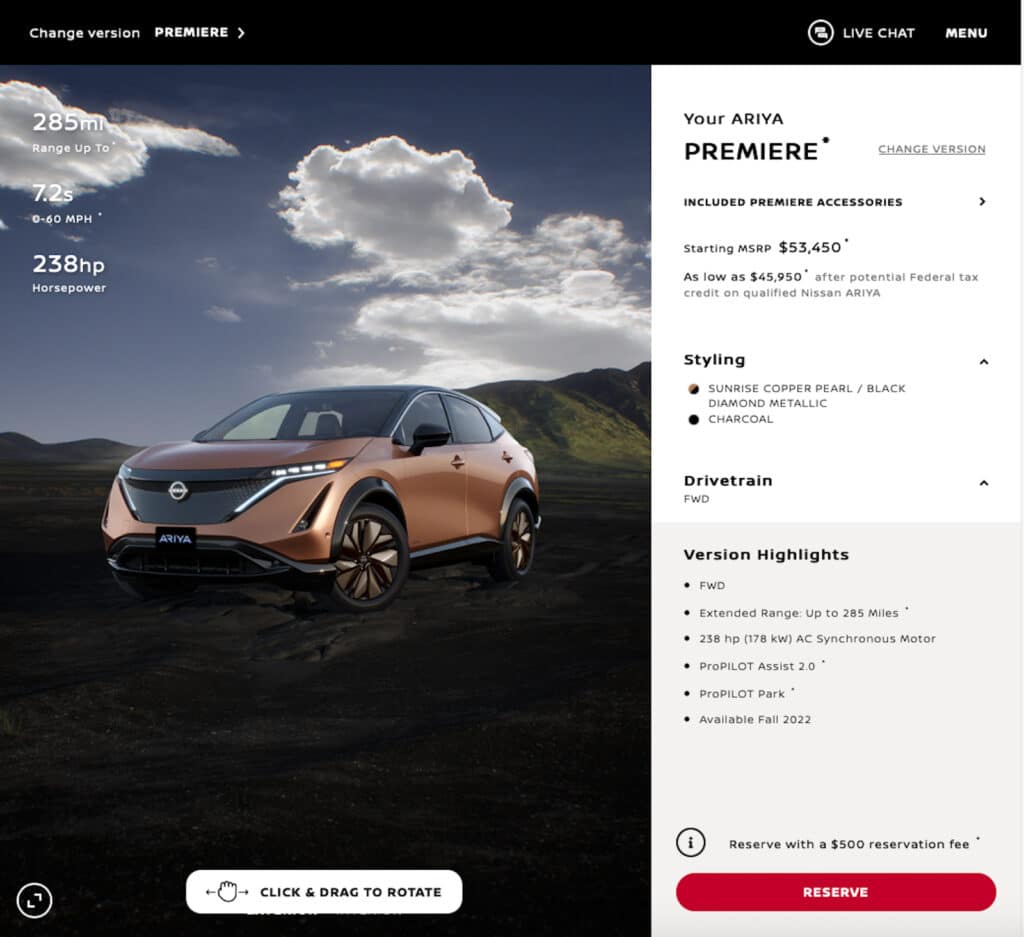

The Year of the EV, Part Duh

2021 was a tough year, but surging demand for battery-electric vehicles, was a major development — sales more than doubling by midyear. We expect to see that upward trend really accelerate in 2022. The formula is coming together, starting with a nearly fourfold increase in long-range products hitting the market. And the Biden administration is ready to begin rolling out a nationwide network of EV charging stations. The big uncertainty: a proposed increase in federal sales incentives could determine just how fast sales accelerate. For now, though, it is stalled in Congress . (Paul A. Eisenstein)

Shortages will drag on and on — and consumers will pay for it

As 2021 dragged to a close, global auto production fell 8 million vehicles short of initial plans due to the semiconductor shortage. Automakers are finding more of the chips essential to every modern vehicle. But it’s far from certain the crisis is over. Meanwhile, the industry faces a number of other potential shortages — everything from rubber to foams, as well as the raw materials needed for EV batteries. For consumers, the chip shortage meant empty dealer lots and record high prices this past year. Expect choices to remain limited in 2022, with no signs that prices will feel the effects of gravity. (Paul A. Eisenstein)

Material wars

The semiconductor shortage underscored U.S. dependence on foreign sources for everything from chips to raw materials. And that’s proving especially worrisome as the industry shifts from internal combustion to battery power. Manufacturers are racing to find local sources for critical elements like lithium, cobalt and nickel, General Motors promising to source virtually everything it will need for its Ultium battery drive technology from North America. But that could take time and testy geopolitics — especially between the U.S. and China — could cause problems near term. (Paul A. Eisenstein)

Biden’s year of living dangerously

Energy will continue challenging President Joe Biden as he oversees the transition from internal combustion to EVs. On one hand, he’s under pressure to keep gasoline prices low, possibly pushing for more domestic oil production. On the other he’s pushing hard for the transition to EVs, reducing the demand for gasoline. Perhaps the biggest challenge for the president will be Congress, however, where his Build Back Better bill — including new EV incentives and broader efforts to address climate change — is stalled. Biden also has to overcome fears the shift to EVs will cost U.S. jobs. (Joseph Szczesny)

Tesla trouble?

Tesla’s the undisputed EV leader. But, as it grows, so does its potential problems. The now-Texas-based company has new plants near Austin and Berlin that could double capacity — if it can avoid past production and quality headaches. Its much-ballyhooed next-gen batteries are delayed, as are products like Cybertruck and Roadster; its relationship with the Chinese government has soured due to concerns about privacy issues due to the cameras the company uses on its vehicles. And Tesla continues to be the target of ongoing investigations by U.S. safety regulators. Is there trouble ahead? (Michael Strong)

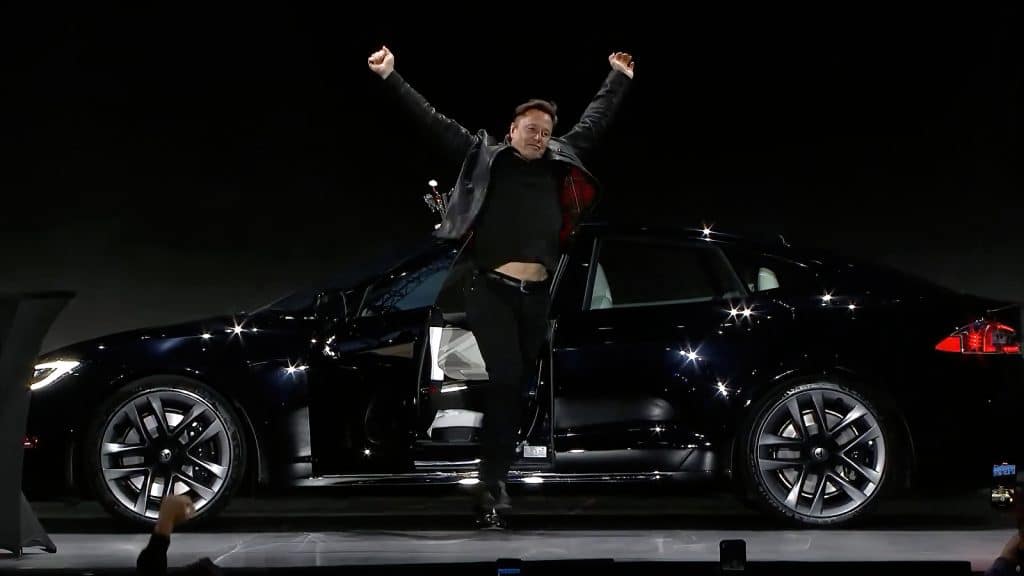

Musk trouble?

Heavy is the head that wears the crown. When you run the most valuable car company in the world — Tesla now carrying a $1 trillion market cap — it’s a big crown. CEO Elon Musk has already wrestled with competitors and governmental agencies. While there appears to be no quit in him, is there a moment where his long-chronicled frictions with governments and some investors while running Tesla, as well as SpaceX and The Boring Co., result in a breaking point? Unlikely, but how much is too much weighs on the minds of some. (Michael Strong)

Startups: The Good, the Bad and the Ugly

The auto industry has been a largely closed club since World War II, at least for startups. But the EV revolution has opened the door and there are plenty of companies looking to duplicate Tesla’s success. That said, the challenges are intense, starting with the need to raise capital. But several wannabe manufacturers have now run afoul of regulators. Nikola recently paid a $125 million fine to end an SEC probe and it’s far from clear Lordstown Motors can survive its flap. Valuations for some startups, such as Lucid and Rivian, are astronomical, but could that come crashing down this coming year? (Larry Printz)

AVs face a critical test

Autonomous vehicles still hold enormous promise for curbing the epidemic of traffic fatalities across the world. But developing the artificial intelligence required for a vehicle to operate autonomously in urban traffic and on high-speed highways is a moon-shot challenge no one has yet mastered despite the billions being invested in the technology. 2022 could prove a critical year as both GM and Mercedes-Benz prepare to bring the first true Level 3 hands-free technology to the consumer market, while companies like Cruise, Waymo and others focus on ride-sharing and commercial fleets. (Joseph Szczesny)

Retail revolution

The last 18 months accelerated two industrywide changes in auto retailing. The pandemic convinced millions to buy vehicles the same way they do almost everything else: online. With no ability to meet in person during COVID lockdowns, automakers and dealers figured out how to make the internet their friend. Going forward, expect far more buyers to shift some or all of the buying process online. Meanwhile, with dealer inventories near record lows, impulse-oriented U.S. buyers are being asked to order their vehicles and wait. Will they go along? Jury’s out. (Michael Strong)

China still wants in — but another communist country could get here first

Yes, a handful of Chinese-made products, like the Buick Envision and Polestar 2, are found in U.S. showrooms. But the long-awaited arrival of domestic Chinese brands like Geely and Great Wall was stymied by the Trump administration, COVID and other issues. With relations between the two superpowers still tangled, it’s unclear if the door will open soon. Ironically, Vietnam is set to launch its first entry into the U.S. late in 2022, VinFast promising to deliver two battery-electric SUVs. (Larry Printz)

Auto Lovers Land

Comments

Post a Comment