Musk Tells Tesla Workers to Ignore “Stock Market Craziness”

It’s been rough times for Tesla investors, the high-flying stock dropping by more than two-thirds since last April and analysts warning the automaker will likely fall short of the “epic” year-end finish promised by CEO Elon Musk. But shareholders aren’t the only ones worrying, as Tesla freezes hiring, temporarily idles production in China and hints at job cuts to come.

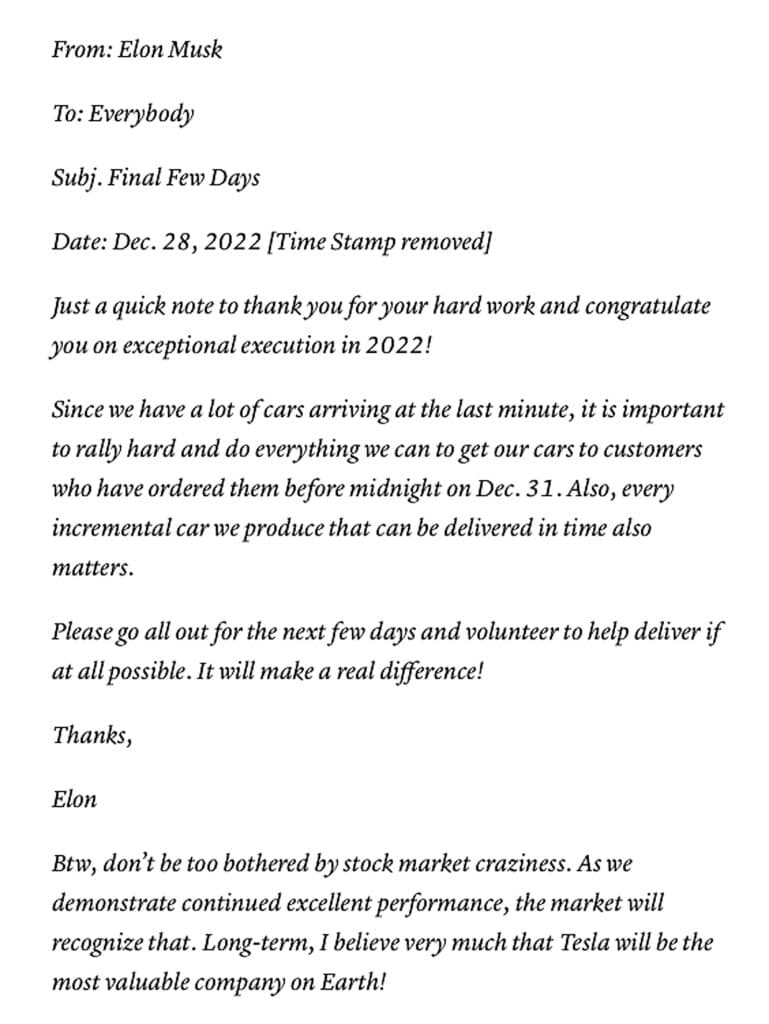

Musk has been struggling to win back increasingly skeptical investors — and is now trying to soothe frayed nerves within the Tesla team itself, advising workers not to be “bothered by stock market craziness.”

Ironically, the note was sent out Wednesday night, just as the Texas-based automaker staged its first upturn on the Nasdaq exchange in weeks, end the day with a 3.3% gain. By Thursday, Tesla was showing signs of even more momentum, the stock up more than $9 a share, at around $122.

A long way down

Tesla shares, traded under the ticker TSLA, have been sliding since last April, not so coincidentally in sync with Musk’s controversial, $44 billion bid for Twitter. From a 52-week high of $402.67, shares dipped to a low of $108.24 earlier this week. In the process, Tesla’s market capitalization has plummeted from a high of around $1.2 trillion to less than $380 billion.

“(D)on’t be too bothered by stock market craziness,” Musk said in his e-mail to Tesla employees. “As we demonstrate continued excellent performance, the market will recognize that. Long term, I believe very much that Tesla will be the most valuable company on Earth!”

Indeed, the ever-optimistic entrepreneur told analysts during an October earnings call that he expected Tesla will eventually be worth more than Apple and Saudi Aramco combined — which, at the time, would have been more than $4 trillion.

That forecast was largely ignored by investors who have become increasingly nervous about a company that for so long seemed capable of defying gravity — delivering multiples no other automaker could match.

“Tesla needs a full-time CEO”

A variety of problems have tripped up Tesla, starting with the Twitter acquisition and the controversial steps Musk has taken since completing the deal Oct. 28. That includes reinstating not only former President Donald Trump but the accounts of a number of white supremacists and Holocaust deniers. He also fired off a series of tweets attacking President Joe Biden, Democratic leaders, Liberals and members of the LGBTQ+ community.

Even some of the most traditionally bullish investors have taken aim at Musk, as well as Tesla, in recent weeks. “Elon abandoned Tesla and Tesla has no working CEO,” KoGuan Leo, Tesla’s third-largest shareholder with holdings worth $3.4 billion wrote late last week. “Tesla needs and deserves to have working full-time CEO,” he added, joining a small but growing chorus of those who have urged the automaker to find a new chief executive.

A weakening EV market

Musk last week said he would step down as CEO of the social media service, though it’s unclear when he will name a replacement. But while that might have salved some critics, there’s growing concern about macroeconomic issues, including weakening sales in the key U.S. and Chinese markets. Gigafactory Shanghai will be shuttered for at least a week to bring inventory in line with demand hurt by the resurgent COVID pandemic.

Worldwide, there is mounting concern that Tesla could end the fourth quarter with sales at least 5% short of Wall Street analysts’ consensus forecast of 435,000 EVs.

It’s unclear what is driving the sudden upturn in Tesla stock. Some observers see investors betting TSLA shares are now a bargain. The high volume of trades may also suggest that large shareholders are attempting to prop up the stock to keep it from sliding under the psychologically significant $100 mark. And there are still those who believe Tesla is poised to turn things around

The bulls aren’t ready to quit

“When we look over the next six to 12 months, and over the next multiple of years, it’s actually pretty positive for Tesla,” Canaccord Genuity analyst George Gianarikas said during an interview with Yahoo! Live on Wednesday.

And influential Morgan Stanley analyst Adam Jonas advised investors in a note that he sees “2023 … shaping up to be a ‘reset’ year for the EV market.” There are “hurdles to overcome,” Jonas said, “Yet we do believe that in the face of all these pressures, TSLA will widen its lead in the EV race.”

Whether that’s possible is a matter of debate considering the number of battery-electric vehicles available in the U.S. market alone has more than tripled this year, with dozens more coming in 2023. Tesla hasn’t added a new product since the Model Y launch two years ago and, despite Musk’s assurances, it’s far from certain the Cybertruck will go into production next year.

Musk calls for a a last-minute push

For now, the automaker is pushing to deliver as many vehicles as it can before the ball drops in Times Square Dec. 31. Among other things, it has taken the rare step of offering $7,500 incentives on both the Models 3 and Y through year-end.

“Since we have a lot of cars arriving at the last minute, it is important to rally hard and do everything we can to get our cars to customers who have ordered them before midnight on Dec. 31. Also, every incremental car we produce that can be delivered in time also matters,” Musk wrote in his e-mail to employees

“Please go all out for the next few days and volunteer to help deliver if at all possible. It will make a real difference!”

A strong, last-minute push could help Tesla meet sales forecasts and further prop up its stock price, analysts said.

Auto Lovers Land

Comments

Post a Comment